A subsidiary established in Russia is a Russian company where a majority of capital or shares with voting rights are owned by a foreign legal entity. For a proper perception of how a subsidiary can be established in Russia, we invite you to contact our team of company formation agents in Russia. We can manage the registration process of your company in Russia, regardless of the chosen structure.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Regions may impose their own legislation |

|

Best used for |

– banking, – insurance, – manufacturing, – trading |

|

Minimum share capital |

Yes |

| Time frame for the incorporation (approx.) |

Around 8 weeks |

| Management (local/foreign) |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Yes |

| Liability of the parent company | No, the subsidiary is liable for its debts and obligations |

| Corporate tax rate | 20% |

| Possibility of hiring local staff | Yes |

Incentives for Russian subsidiaries

Numerous incentives are offered for the subsidiaries, especially financial exemptions, due to the vast network of treaties signed by Russia over the years. For example, the withholding taxes on dividends, interests or royalties paid to a company from a country with a signed treaty are minimized or abolished. The profits are taxed only in the country of origin or, if they are paid, the amount is refunded. The main regulations of the subsidiaries opened in Russia are given by the Civil Code of the Russian Federation. Also, we are at your disposal with information and assistance about how to establish a subsidiary in Russia.

If you decide to open a company in Russia, we recommend the support of our accountants in Russia. There are a number of procedures imposed by law for company owners, and among them, is alignment with accounting standards. Thus, our specialists can offer you payroll services, bookkeeping, tax compliance, and submission of annual financial statements.

The incorporation of a subsidiary in Russia in 2024 is advantageous. Such a structure is not connected to the parent company when it comes to the operations carried out. As such, the parent company decides if a Russian subsidiary can develop the same activities or other operations.

How can I open a subsidiary in Russia in 2024?

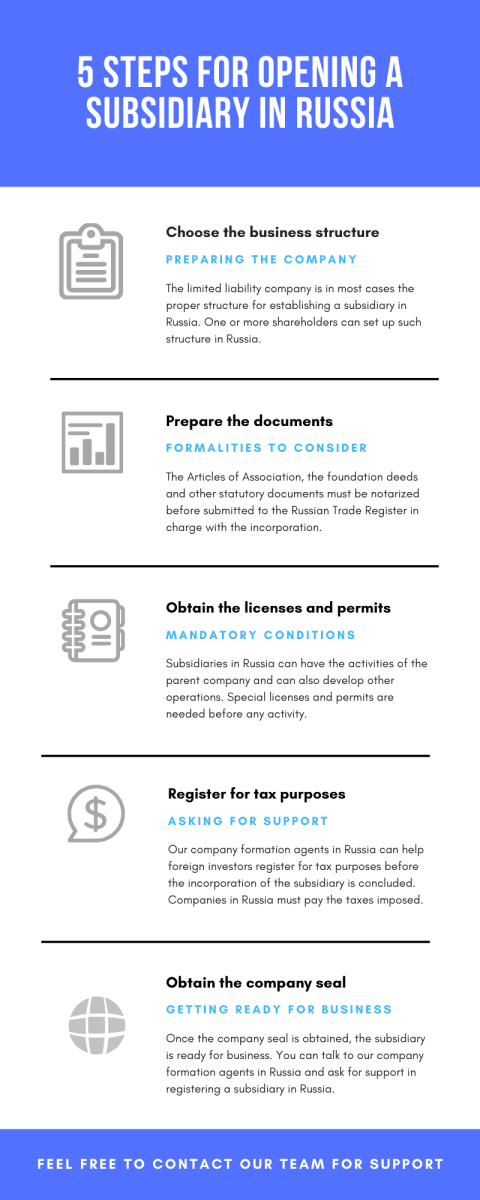

A foreign investor can incorporate a subsidiary in Russia in 2024 in the form of a private limited liability company and a public limited liability company, open or closed. The limited liability company can be founded by one or more shareholders (maximum 50), with a minimum share capital of RUB 10,000. Half of the minimum share capital must be deposited in a bank account before the registration is done, and the other half in a maximum of three months from the date of incorporation. You should also consider the following steps in a subsidiary formation in Russia:

- • the management is assured by a board of directors and an executive committee, appointed by the general meeting of the shareholders;

- • the capital of such a company is divided into non-transferable shares;

- • the liability of the shareholders is determined by their contribution to the capital;

- • a subsidiary needs to be registered with the tax authorities in Russia.

More about how to open a subsidiary in Russia in 2024 and the requirements that must be respected can be discussed with our Russian specialists.

We can also provide you with accounting services in Russia.

Starting a subsidiary in Russia requires a single shareholder. The type of structure selected requires a specific minimum share capital. As such, the limited liability company or a closed joint stock company needs a start-up capital of RUB 10,000.

Subsidiaries registered as joint stock companies in Russia

Two types of joint stock companies can be registered in Russia: open – when the shares are freely transferable to the public, or closed – when the shares are transferable only between the shareholders in the company. An opened joint stock company is based on a minimum share capital of RUB 100,000 while RUB 10,000 represents the minimum share capital that must be deposited by the closed joint stock company. The management is assured by the general manager, but if the company has more than 50 shareholders, a board of directors must be appointed. Also, a supervisory board can be appointed, but it’s not mandatory.

What is the registration process for a subsidiary in Russia?

The registration of joint stock companies takes around one month and consists of:

- notarizing the foundation deeds, and depositing the minimum share capital in a bank account;

- registering for a single number of state registrations and the number of tax identifications from the Federal Tax Service;

- notarizing the bank signature card and making a seal for opening the permanent bank account;

- informing the Federal Tax Service regarding the opening of the bank account;

- registering at the Moscow Center of Quotation of Work Places.

Subsidiaries in Russia are not that expensive to register, compared to branches. There are many tax benefits for subsidiaries, and among these, enjoying the provisions of the double tax treaties signed by Russia with more than 79 countries. You can also watch the following video presentation on this subject:

Who can open subsidiaries in Russia?

All medium and large companies from overseas can easily establish subsidiaries in Russia, with respect to the Company Act and other business-related sets of laws in this country. We remind you that foreigners have the same business rights as Russians and can also benefit from a series of incentives provided by the government.

International entrepreneurs looking to establish subsidiaries in Russia mostly choose important sectors like insurance, banking, trading, and manufacturing. A subsidiary in Russia can be established as a joint stock company or other structures.

Necessary documents for opening a subsidiary in Russia in 2024

With complete support offered by our team of company incorporation consultants in Russia, a subsidiary is registered with documents like the Articles of Association (in a notarized form), the declaration provided by the foreign company that intends to open a subsidiary in Russia, statutory documents, and the registration application form. The Russian Trade Register is in charge of subsidiary incorporation in Russia. Complete information about how to establish a subsidiary in Russia in 2024 can be provided by one of our Russian specialists in company formation.

A subsidiary in Russia cannot have more than 50 shareholders. RUB 10,000 is the minimum share capital for subsidiaries in Russia. The registration formalities can be attentively handled by one of our local agents with experience in business formation in Russia.

Choosing between subsidiaries and branches in Russia

Both domestic and international entrepreneurs have the same business rights in Russia, however, they need to choose the proper entity that suits most of the needs and activities they want to develop. In this case, it is recommended to understand in the first place the differences, advantages, and disadvantages of branches and subsidiaries in Russia. For example, a branch will completely depend on the parent company, compared to the subsidiary which is 100% independent. In matters of registration costs, branches are more expensive compared to subsidiaries.

Also, there are restrictions when it comes to licenses and permits, meaning that branches cannot perform specific operations, a matter where subsidiaries are advantageous. A branch will only have to develop the specific activities as established by the foreign company, while the subsidiary in Russia is free to change the operations or add new ones if that is the case. As for the taxation of these entities, the profits of subsidiaries are protected by the double taxation treaties signed by Russia with countries worldwide, while branches will only pay the taxes imposed on the incomes registered in Russia.

Subsidiaries in Russia cannot be registered without a business address, as this is one of the main requirements. In the case of foreign founding members, some immigration matters, such as visa and residence should be observed.

Do not hesitate to ask for more details about each entity, if you need recommendations in terms of business and company registration of a branch or a subsidiary in Russia. Our support can be immediately offered to foreign investors, alongside legal advice provided by our local team of attorneys in Russia.

Accounting services for subsidiaries in Russia

Subsidiaries might seem complicated from a taxation point of view, but instead of dealing with such aspects, you can decide on the services of an accounting firm in Russia. This is in many cases the ideal choice of foreign entrepreneurs in Russia instead of creating a whole new accounting department.

Tax registration and reporting, tax planning, payroll services, audits, annual financial statements, tax management, and tax minimization methods are part of the accounting services we can provide for your subsidiary in Russia if you decide to hire us.

Foreign companies can easily establish their operations in Russia, but above all, it is highly recommended to align with the requirements in terms of taxation and reporting. This is where the support of our experts will play a major role in all financial aspects of the firm, organizing professional tax reporting and accounting in respect of the applicable laws.

The advantages of subsidiaries in Russia

Subsidiaries in Russia are separate legal entities and are not limited in matters of business licenses and can apply in agreement with the applicable laws. The double taxation treaties signed by Russia with different countries worldwide apply to all subsidiaries in Russia in terms of taxation. It is good to know that the registration process of a subsidiary in Russia is not time-consuming or bureaucratic, letting foreign companies establish their operations rapidly.

Why choose us for opening a subsidiary in Russia

Our company formation specialists in Russia have enough experience to support international investors on their way of settling the activities from abroad. Many entrepreneurs from abroad have chosen our services and relied on the complete support for company registration with the entitled authorities. A foreign businessman might not be familiarized with the local rules and regulations in matters of company formation and incorporation which is why the assistance and the help of our company formation representatives in Russia might be crucial.

Instead of dealing with all sorts of errors or misapprehensions when opening a subsidiary or any business structure in Russia, international investors can rely on the assistance, experience, knowledge and correct approach provided by our team of consultants. Our company formation services in Russia are varied and at the disposal of anyone wanting to open a subsidiary in Russia with fewer formalities or stress in terms of incorporation.

Those who want to know more about the investments and business in Russia might find interesting the following information:

- UK, the Netherlands, Ireland, Bermuda, and Cyprus are the main investors of Russia.

- Approximately USD 464 billion represented the FDI flow registered in Russia in 2019.

- Russia ranked 28th out of 190 worldwide economies, according to the “2020 Doing Business Report”.

- Oil, gas and metals are Russia’s main resources which can be exploited by international companies.

- Mining and manufacturing are the main industries where international investments are directed.

- More than 70% of the costs in the research and development sector can be deductible in Russia.

There are no complicated bureaucracies when setting up a company in Russia in 2024, whether a branch or a subsidiary. If you want to register a subsidiary in Russia, you may contact our Russian company formation agents who will provide you with all the information you need and will help you with the registration procedure.